10 Big Retirement Mistakes To Avoid - A Malaysian Guide

Image is from xframe.io

One of the biggest retirement mistakes you can make is not realizing what you don’t know. The reality is that most people don’t get good and objective financial advise before they retire.

There are many ways your retirement can go wrong. Here are the top 10 retirement mistakes retirees commonly make and steps you can take to avoid them.

Retirement Mistake # 1: Cashing out all from EPF and parking into a Saving account.

Can you withdraw all your EPF (Employee Provident Fund) money after the age 55? Technically YES. However, just because you can withdraw all your money from EPF, does not mean you should.

And, don’t simply keep the money in a Savings or Current account. The money kept there does not grow and you’ll spend it like water coming out of the tap.

What you can do:

Diversify your retirement fund into a few places. My recommendation is:

10% – for usage in a year (daily commitment)

20% – ASB/ ASW/ Tabung Haji

20% – Principal funds or Unit Trust (with diversified portfolio equity, balance, sukuk)

50% – remain in EPF account

Retirement Mistake # 2: Underestimate the cost and length of retirement

Many people think they will spend less when they retire. However, study shows that 33% of retirees say that their spending is the same or greater than before. Plus, if you are healthy at the age of 65, you could live another 20 to 30 years.

One of the biggest retirement mistakes many people make is underestimating the expenses in retirement. Among the reasons are:

- Ignore the impact of inflation on their expenses;

- Not knowing the medical cost required later in life;

- Unplanned big-ticket expenses such as major house repairs, kid’s wedding, and more.

What you can do:

You need to know what your monthly expenses are after retirement. It shall include food, utilities, health insurance, long-term loan, transport and other wants.

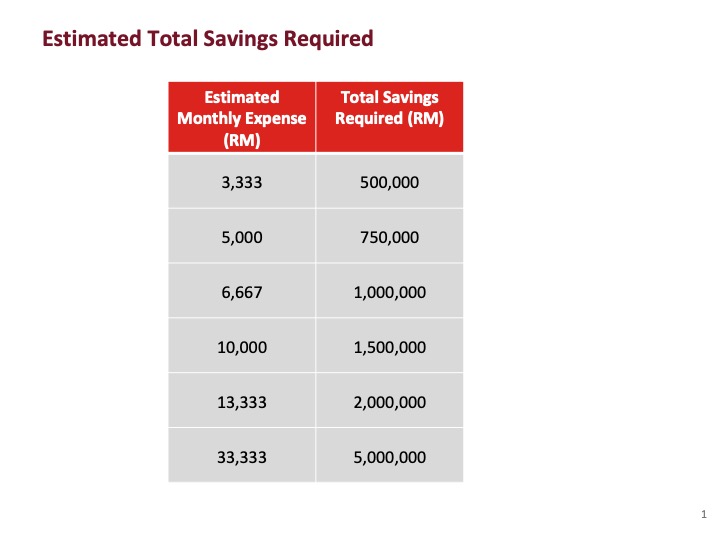

Once you’ve determined the monthly expense, then you should calculate backwards to determine how much savings you need to build up. For example, if you want to have a $10k monthly expense, then you need to have $1.5 Mil in your total account.

Check the table below for the amount of savings you required for monthly expenses.

Related: Refire, Not Retire

Retirement Mistake # 3: Assuming you can work longer

About half of the retirees report leaving the workforce earlier than they had planned. Some are lucky as they get company packages or windfalls. Others retire because they lose their job and cannot find a replacement or because of ill health.

As a financial consultant, I have met a lot of retirees that have had to retire in their early 50’s due to office politics, lost of job or being retrenched.

What you can do:

No matter how much you want to keep working, it’s no excuse to not save for your retirement. Save or invest 10% – 15% of your income for retirement savings.

Retirement Mistake # 4: Spending too much too soon

I understand the temptation. Especially when you see a big sum of money and feel that you deserve to spend it as you have worked this long. But spending your EPF money without a proper plan is a poor financial decision.

Normally, retirees tend to spend the money on house renovation, travel, kids’ college fees, kid’s grand wedding, and more. However, spending money you have not budgeted for will eat away your retirement savings quicker than anticipated.

Retirement Mistake # 5: Carrying debt into retirement

Being in debt when there is no steady income is a serious concern. The more debt you have, the quicker you will run out of your retirement savings.

What you can do:

Ensure there is no consumer debt by age 50, that is, you should not have any personal loans, cash rewards loans, or a huge credit card debt.

Try to pay off debts as much as possible. For example, car loan, housing loan.

Retirement Mistake # 6: Playing the stock market

Stocks are highly volatile and stock prices can fluctuate from one day to the next. If you invested in higher risk, higher return stocks, the value can decline just when you need them. And they may not recover before you exhaust them.

To double your money in a short period of time by dabbling in the stock market is not worth it - the risk is too high. This includes bitcoin, forex trading, multilevel marketing, and skim cepat kaya (quick rich scheme).

What you can do:

Limit the alternative investment to not more than 10%. An alternative investment other than EPF is ASB, Tabung Haji, fixed deposits, bonds, and unit trust fund.

If the investment is capped at 10% of your net worth and you lose it, it is still survivable.

Retirement Mistake # 7: Failing to prepare for medical expenses

Medical cost is not cheap nowadays. Hence, having good medical health insurance is essential. Furthermore, many healthcare expenses, like dental costs, eyeglasses, and hearing aids are often not covered by insurance/takaful.

What you can do:

Ensure healthcare costs and medical card premiums are included in your annual budget.

Keep your body healthy. Being healthy can save you a lot of money in the future. Eat healthy, be physically active, read and think, quit smoking, sleep enough, and more.

Retirement Mistake # 8: Relying too much on EPF savings

Many people think EPF savings are enough for retirement. However, a study showed that 70% of ex-EPF members exhausted their EPF savings within 10 years.

Why? Look at this logic.

On average, a person contributes 11% to EPF, and an employer’s contribution is about 12%. So the total monthly contribution for a person is about 23%. If the person withdraws money from EPF account 2 for house or education needs, then the percentage of total contribution is reduced to 17%.

Additionally, after retirement, should you not downgrade your lifestyle by 15 – 20% of your usual monthly expenses, then EPF savings would be exhausted really fast.

What you can do:

Be RESPONSIBLE to Yourself.

You need to complement your EPF savings with your own personal savings. Save or invest 10% – 15% of your income for your retirement.

Retirement Mistakes # 9: Putting your kids first

All parents want what’s best for their kids. But you don’t want to exhaust your retirement funds by being too generous to your adult kids. Think long and hard before you contribute towards the down payment of a car or house, or finance grand weddings, and more.

What you can do:

Talk to your kids about their funding options. If they don’t have enough money to pay for their dream car down payment, they might need to look for a smaller car. Or, look for a less expensive home.

As much you want your kids to be successful, there needs to be a balance.

Retirement Mistakes # 10: You own too much stuff

You probably have too much stuff.

Some of us enjoy collecting stuff. There may be more than two cars, motorbikes, expensive watches, branded bags, and more. When you have a lot of stuff, it means you need more storage, you spend more time and money for maintenance and repairs, and more time to clean them.

I often watch the ‘American Pickers’ tv series. Many parents who collect items, end up with their kids not wanting them and the items are sold for quick money.

What you can do:

Retirement is an excellent time to simplify your life. You can determine what things you really need and want. Maybe you could consider selling some of your unused or collectible items. Use the money towards your retirement savings or a fun experience.

Don’t get your heart set on gifting your items to your children. They might have different priorities and do not value them.

You might enjoy these too:

This article was first published on khairulabubakar.com

The author here suggests that you can invest some funds to prepare yourself for your retirement needs. Unless you are a pro or a qualified financial planner, investing is a daunting task. So where do you start? Watch this video! Disclaimer: The views expressed in the video below belong to the interviewee and not Leaderonomics, its directors, its affiliates, or employees.

Discover more about retirement financial planning through this amazing learning app called Necole. Necole is a state of the art learning platform that curates personalised learning just for you. To find out more about necole, click here or email info@leaderonomics.com

Personal

Tags: Financial crisis, Hard Talk, Consultant Corner, Finance